Ministry of Economy, Trade and Industry of Japan Chooses Upcoming IHI Transition Bond Issue as One of its 2021 Climate Transition Finance Model Projects

IHI Corporation announced today that it has decided to issue transition bonds in fiscal 2022.

Companies issuing transition bonds use the proceeds to fund efforts to tackle climate change by cutting greenhouse gas emissions as part of long-term strategies to help decarbonize economies. The Ministry of Economy, Trade and Industry selected IHI’s offering as one of its 2021 Climate Transition Finance Model Projects.

IHI’s transition bonds will finance initiatives to reduce Scope 1 and 2 greenhouse gas emissions from its own operations and support endeavors to lower Scope 3 emissions from upstream and downstream processes.

IHI developed a Transition Bond Framework (see note 1) for this issuance. The transition strategy under that framework encompasses roadmaps for a range of sectors. These include chemicals, electricity, and gas (for the Ministry of Economy Trade and Industry), and marine transportation and aviation (for the Ministry of Land, Infrastructure, Transport and Tourism). The strategy also covers international scenarios, including for the International Energy Agency and the International Air Transport Association. IHI obtained a second-party opinion from Japan Credit Rating Agency, Ltd., relating to conformity assessments, including for the International Capital Market Association’s Climate Transition Finance Handbook 2020 (see note 2).

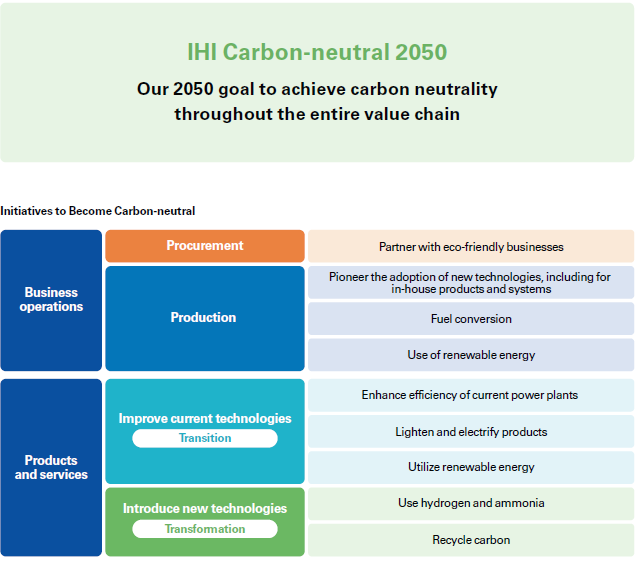

IHI Group has positioned climate change as a central business challenge in keeping with its Corporate Philosophy “Contribute to the development of society through technology” and “Human resources are our single most valuable asset”. It pledged in IHI Group ESG Management, which it announced in November 2021, to achieve carbon neutrality across its entire value chain by 2050.

Bond Issue Overview

|

1.Issue size |

Up to ¥20 billion |

|

2.Issuance timeframe |

Between April and June 2022 |

|

3. Third-party evaluation entity |

Japan Credit Rating Agency, Ltd. |

|

4. Proposed fund uses |

|

|

5. Structuring Agent (see note 3) |

Mizuho Securities Co., Ltd. |

|

6. Lead manager |

Mizuho Securities, as well as other entities to be determined |

- See appended PDF, titled IHI Corporation Transition Bond Framework

PDF - See the link of evaluation from Japan Credit Rating Agency, Ltd.

https://www.jcr.co.jp/en/greenfinance/green/ - A structuring agent advises issuers on developing transition bond frameworks and on securing second-party opinions and other external third-party evaluations.

Schedule

IHI will announce the issue date as soon as possible after comprehensively assessing market demand and interest rate trends to determine terms and conditions.

IHI Carbon-Neutral 2050

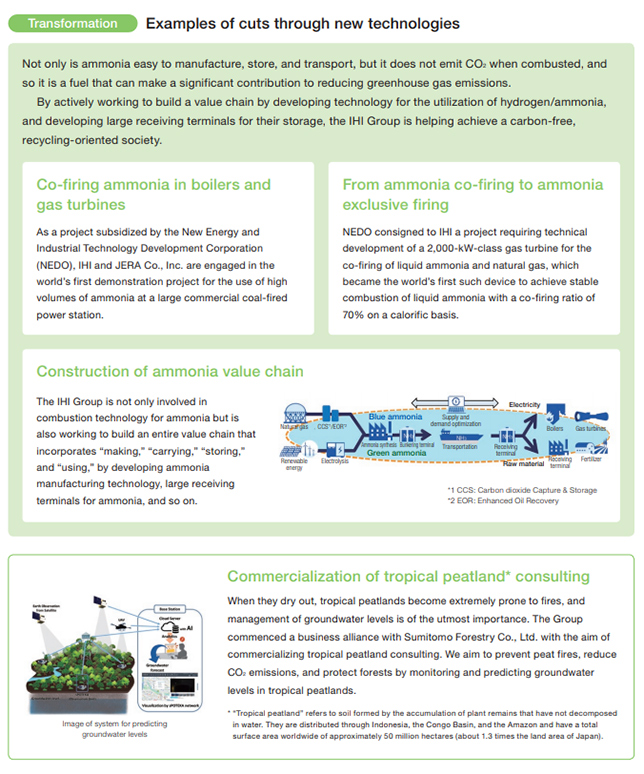

Key Product and Services Transitions and Transformations