Remuneration of Directors (Excluding Independent Directors)

-

Basic Policy on Determining Remuneration

- Remuneration shall be aimed at fully encouraging Directors and Executive Officers to perform their duties in line with management philosophy, Group vision, and Group management policy, and strongly motivating them toward the achievement of specific management goals to bring IHI’s and the IHI Group’s sustainable growth and improve the medium- and long-term corporate value.

- Remuneration shall be structured with the appropriate allocation of a fixed base amount, an annual incentive (performance-based bonuses), which is linked to the operating performance of each fiscal year, and a long-term incentive (performance-based share remuneration and restricted share remuneration plan), which is linked to medium- and long-term operating performance and corporate value aimed at broadly sharing a sense of value with stakeholders, and thereby shall contribute to performing with a sound entrepreneurial spirit.

- Under the management philosophy, “Human resources are our single most valuable asset,” appropriate treatment shall be provided to Officers of IHI in consideration of IHI’s management environment, and social roles and liabilities IHI undertakes.

-

Remuneration Level and Allocated Ratios of Remuneration

- IHI shall appropriately establish remuneration levels and allocated ratios of remuneration upon having considered factors that include IHI’s business characteristics, effectiveness of incentive remuneration, and professional duties. Moreover, the Company shall perform verification by regularly surveying objective market data on remuneration researched by an external specialized institution.

- In the case of standard business performance, total amount of remuneration shall be allocated at approximate proportions of 50%:30%:20% for the Director and Chairman of the Board, and the Representative Director and President, and at approximate proportions of 55%:25%:20% for other Directors respectively to a fixed base amount, an annual incentive, and a long-term incentive provided upon the achievement of the targeted performance. In addition, long-term incentive shall be allocated at approximate proportions of 50%:50% for the performance-based incentive and restricted share remuneration respectively.

-

Framework of Incentive Remuneration

-

Performance-based bonuses (Annual incentives)

-

Performance indicators and reasons for selection thereof

Performance indicators shall be those that include: profit attributable to owners of parent underpinned by the aim of maintaining common interests with our shareholders; consolidated operating cash flow underpinned by the aim of strengthening the capacity to generate cash necessary for growth; and ESG indicators* aimed at promoting ESG management. The performance indicators shall be reviewed as necessary, particularly upon encountering changes in the management environment and Officers’ duties.ESG indicators are used to evaluate efforts to reduce greenhouse gases, improve employee engagement, and promote DE&I.

-

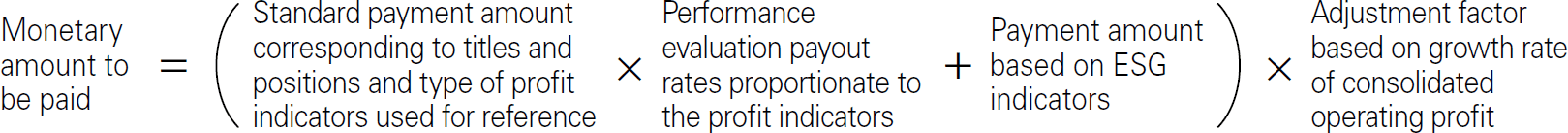

Method of calculating remuneration

The monetary amount of remuneration provided every fiscal year is calculated as follows, and the performance evaluation payout rate varies from a range of zero to approximately 200 depending on the percentage achievement of profit indicators, with a baseline value of 100 for the amount of payment when performance targets have been achieved. In addition, regardless of the calculation results, the annual incentive is not paid to Directors if no dividend is paid.

-

Performance indicators and reasons for selection thereof

-

Performance-based share remuneration (long-term incentives)

-

Performance indicators and reasons for selection thereof

The performance evaluation period shall encompass the next three fiscal years, and performance targets for the final fiscal year of the performance evaluation period shall be established at the outset of the performance evaluation period. Moreover, the performance indicators shall be of primary emphasis under the Group management policies, with consolidated ROIC serving as a performance indicator underpinned by the aims of engaging in business operations that place focus on investment efficiency, achieving sustainable growth, and increasing corporate value. IHI shall furthermore review the possibility of making change to the performance indicators as necessary in alignment with review of the Group management policies. -

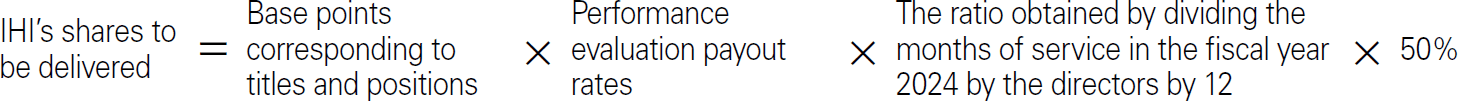

Method of calculating remuneration

The number of shares to be delivered as performance-based share remuneration is calculated as follows, and the coefficient varies from a range of zero to approximately 150 depending on the extent of having achieved such target, with a baseline value of 100 for the number of shares to be delivered when performance targets have been achieved. A monetary sum equivalent to the market value of the shares is to be delivered with respect to a portion of such remuneration.

-

Performance indicators and reasons for selection thereof

-

Restricted share remuneration plan (long-term incentives)

In each fiscal year, the transfer restricted shares equivalent to the granted points, which are defined by position, will be awarded.

The transfer restriction period is the period from when the shares are issued until the officer retires for the purpose of strengthening management that is conscious of stock price and the connection with corporate value.

In addition, the number of shares to be issued as restricted share renumeration will be determined as follows, and part of the compensation will be paid in the form of money equivalent to the market value of the shares.

-

Performance-based bonuses (Annual incentives)

-

Remuneration for Officers Who Are Serving Outside Japan

If deemed necessary for the execution of their duties, an allowance may be paid separately for expenses, etc., as determined by IHI, taking into consideration local laws and regulations, customs, levels, etc., pertaining to remuneration, and remuneration may also be determined individually, taking into consideration local market levels, etc.

For the allowance, the equivalent amount of money shall be paid as part of the base amount. -

Procedures for Determining Remuneration

To ensure appropriateness and objectivity regarding matters of officer remuneration, including remuneration for individual Directors, the Board of Directors shall make decisions on such matters subsequent to deliberation and reporting findings thereof by the Remuneration Advisory Committee established as an optional body by IHI. -

Other Significant Matters

-

Incentive remuneration

IHI has adopted a mechanism under which IHI does not pay the unpaid portion (malus) and recoups remuneration already paid (clawback) for annual and long-term incentives in the case of events such as revision of business performance which is the basis of remuneration, violation of laws and regulations by eligible officers or serious violation of the contract of mandate between IHI and eligible officers.

In addition, regardless of the calculation results, if no dividend is paid, the annual incentives are not paid to Directors. -

General remuneration

In the event of a net loss attributable to owners of parent for the current term, political, economic, or social conditions, or major changes in management not anticipated in the initial term plan (including scandals that could harm corporate value), changes to the content of remuneration, etc., will be decided by the Board of Directors after consulting with and receiving a report from the Remuneration Advisory Committee.

-

Incentive remuneration